Board Chair and Chief Executive address

Murray King and David Chin talk through LIC's half-year result

- Total Revenue from Continuing Operations, up 4.6% at $177.2 million

- Net Profit After Tax (NPAT) from Continuing Operations: $33.3 million, down 6.4% from the same period last year

- Underlying Earnings forecast range at year-end: $21.5-25.5 million (previously $20-26 million)

- 2023-24 Underlying Earnings forecast range: $22-28 million

LIC has released a strong half-year result for the 2022-23 financial year, despite cost pressures, confirming it is on track to deliver a year-end result in line with expectations and guidance previously provided to the market.

Reporting increased revenue (up 4.6%) but a drop in profit (down 6.4%) compared to the same period last year, Board Chair Murray King says he is pleased with the result given the current challenging economic conditions.

“Like many other Kiwi businesses, we’ve been challenged during this time by staff shortages, a weaker kiwi dollar and rising costs associated with record inflation, but we’re pleased to confirm we remain on track to achieve a strong result at year-end and keep up the positive momentum from our previous years’ performance.

“On behalf of the Board, I want to thank our farmers for their continued support, particularly as they are facing these same headwinds. A special thanks also to our team who have rallied together through staff shortages to continue to deliver a reliable service to our farmers. I look forward to presenting the full year result in July.”

King says the increased revenue was driven by further growth in uptake of the co-op’s premium bull genetics and animal health tests, which reflects growing commitment from farmers to breed the best cows, faster.

“Kiwi farmers are continuing to sharpen their focus on herd improvement to help meet their environment goals, investing in their herds now so they’re sustainable and profitable into the future. We’re proud to be part of the solution for this, enabling them to breed genetically superior animals which produce more milk with a lower environmental footprint, and at a faster rate.”

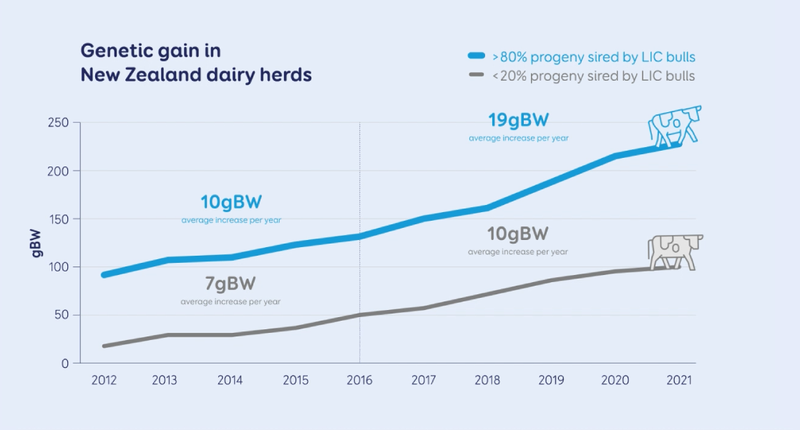

Recent research has found that long term users of LIC genetics have almost doubled the speed of improvement in their herds over the last decade (10gBW per annum 2012-2016, to 19gBW per annum 2017- 2021), while farmers who don’t use LIC genetics have had lower rates of genetic gain over the same period (7gBW to 10gBW).

King said the co-op’s prolonged and substantial investment in genomics has been the key contributor of this improvement as the technology enables accurate identification of elite bulls at a younger age so they can be made available to farmers earlier and fast track the rate of genetic gain on farm.

A record graduation rate of young bulls joining LIC’s artificial breeding (AB) teams this season is also testament to its work in genomics, after the superior performance of these bulls predicted by genomics was validated by herd testing data from their first crop of daughters now being milked on farms across the country.

“It’s incredibly pleasing to see farmers are reaping the rewards of their co-op’s investment into genomics on their behalf – both in their herds now with the increased speed of improvement and also with a strong pipeline of elite genetics to support them into the future.”

The increasing uptake of cow wearable devices was also reflected in the result, as more farmers extended their herd’s artificial breeding period, capitalising on the devices’ heat detection capabilities to utilise short gestation genetics.

“These devices provide farmers with real-time data and insights to monitor their cow’s performance, health and fertility and we’re pleased to partner with wearables suppliers (Afimilk, Allflex via Protrack, CowManager, Datamars Tru-Test, Halter, SmaXtec and Waikato Milking Systems) to enable two-way flow of this data between the devices and our herd management software (MINDA).”

King said other highlights from the reporting period include the promising results from the co-op’s methane research programme which confirmed bulls’ genetics play a role in how much methane they emit, highlighting the potential for farmers to breed low methane-emitting cows in the future. This work has now progressed to mating bulls identified as low and high methane emitters to test whether the variation is passed on to their daughters. Research to breed more heat tolerant cows is also continuing.

The co-op’s market guidance for year-end has been tightened, with Underlying Earnings now expected to be in the range of $21.5-25.5 million (previously $20-26 million). The co-op is also forecasting 2023-24 Underlying Earnings in the range of $22-28 million.

King said the co-op’s focus to year-end is to continue working hard to deliver its three strategic commitments in the co-op’s strategy - operational excellence, faster genetic improvement and software reliability and performance.