Last week DairyNZ released a proposal for feedback on a single national animal evaluation breeding index that incorporates genomics (NZAEL 3.5).

The consultation should help to shape DairyNZ’s ambition and set their focus for their investment decisions going forward.

Although we have been engaged with DairyNZ in the lead-up to this consultation to include genomics in animal evaluation, we do not endorse the proposal that has been suggested.

We agree in principle to a single index, however where our views diverge is around the actual value that this would unlock for New Zealand dairy farmers with the model that has been proposed.

There are two key things for you to note as an LIC shareholder:

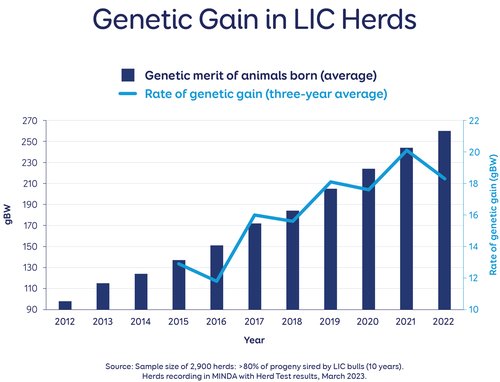

1. We’re already getting higher rates of genetic gain. Long-term users of LIC genetics have almost doubled the rate of genetic gain in their herds over the last 10 years – now at 18gBW per annum (graph below).

This surpasses the industry average of 10BW, as stated by DairyNZ. In fact, we have already surpassed the DairyNZ proposal's goal of 15BW.

Genomics has been a key contributor to this success. The technology is widely available to LIC’s 9,000+ farmers and it is delivering significant value on-farm which will benefit your herds for years to come.

2. There's a lack of evidence that there will be value returned to the industry from the model, especially when New Zealand farmers, through LIC, have already made the investment into a state-of-the-art genomic model and made further investments into the collection of over 300,000 genotypes.

We will submit a response to the proposal and share this with you seven days before the consultation ends.

In the meantime, your co-op will continue to roll up our sleeves and generate elite genetics for NZ farmers and invest in R&D and bring new and innovative products to the market. Our unwavering focus remains on delivering accelerated rates of genetic gain and enhancing the profitability of your herd.

Thank you for your ongoing support.

Regards,

David Chin

Chief Executive

*This was emailed to LIC shareholders on Monday, 22 May 2023.