Shareholders approved the move to a single share structure at a special meeting in March 2018. Ministerial approval, required under the Dairy Industry Restructuring Act, was received in April 2018.

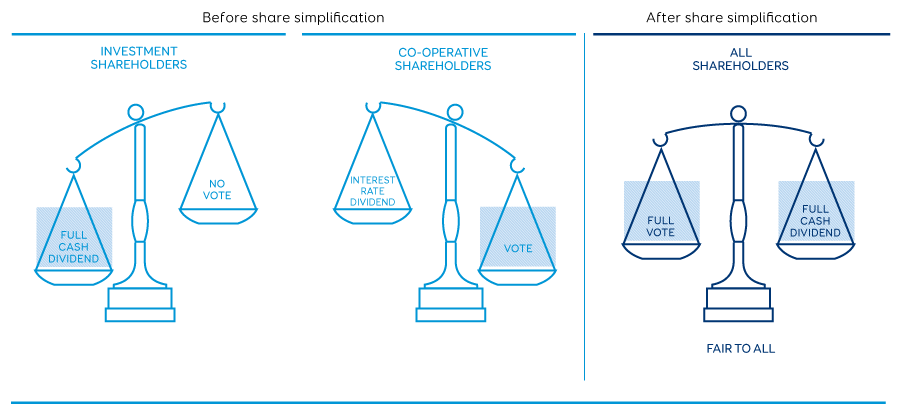

Prior to the share simplification, LIC had a dual share structure with two kinds of shares:

- Co-operative control shares — compulsory for qualifying farmers.

- Investment shares — could only be purchased by holders of co-operative control shares.

The Board proposed to simplify LIC’s share structure by bringing the two classes of shares together into a single class to:

- Protect the co-operative principles that are fundamental to LIC

- Ensure a fairer system that treats all shareholders equally

- Give LIC capital flexibility to respond to inevitable future challenges and opportunities

- Support LIC’s strategy (Vision, Purpose,Strategic Themes and Values)

- Deliver a simpler share structure with less hassle for shareholders and LIC

More information

- Introduction to LIC’s share simplification

- Notice of Meeting

- Independent Advisers Report

- Valuation of shares - PwC confirmation letter

- Email our Share Registry Team at [email protected] or call 0800 542 742.